Imagine this…… you have a new job

Hey,

Congratulations on your new job as as Head of PR at Sky. Here’s hoping you last a little bit longer than Trumps last communications director. Anyway I know it is your first day and we have a bit of a doozy for you. There is a bit of noise on Facebook from a customer, shouldn’t be too much of an issue but can you look into it?

Good Luck.

Here is a little bit of background for you:

So the little bit of noise on facebook started as a rant from a customer, has 17,000 likes, 3,000 comments and has turned into national headlines. Ex Sky customer Zane Young said he was “extremely pissed off” and was leaving Sky because at $140 per month it had become too expensive compared to other TV options. In his words

- After being so loyal to you for over 7 years, paying $140 a month and spending over $11,700 in that time I’m disappointed. You’re like an ex girlfriend, the only time I ever hear from you is when you want money.

- Yet out of the blue a friend who often comes to my house to watch the rugby gets a phone call ” Hi Mr X this is X here from Sky Tv. Because you are not a customer of sky we would like to offer you a deal to join. How does sky tv and sky sport for just $40 a month sound? The term is a 6 month minimum with full term of 12 months.

- If it wasn’t for the rugby I would of gone sooner but due to you not showing me the same loyalty I showed you – I’m gone.

- Thanks for the memories

- Good bye sky my old friend, I won’t be back to talk again…….

So there are really two things that are going on in this little exchange:

- Customers feel hostages about paying full price to watch rugby on Sky

- Customers feel aggrieved that new customers get better treatment

Let’s have a little look at these:

Issue 1) Customers feel hostages about paying full price to watch rugby on Sky.

We have covered a bit of this in the past, Sky’s churn problem, increasing costs, globally the cable market is contracting, their pricing strategy, how they turned off their popular online package, and how businesses profit from their hostages customers. Oh yes, and how you can get all of the other digital offerings in the market for less than the base price of Sky. So I had to dig deep to find some new information, but as you know the interwebs is full of useful information. So let me throw two more bits of bad news for Sky from The State of Traditional TV report:

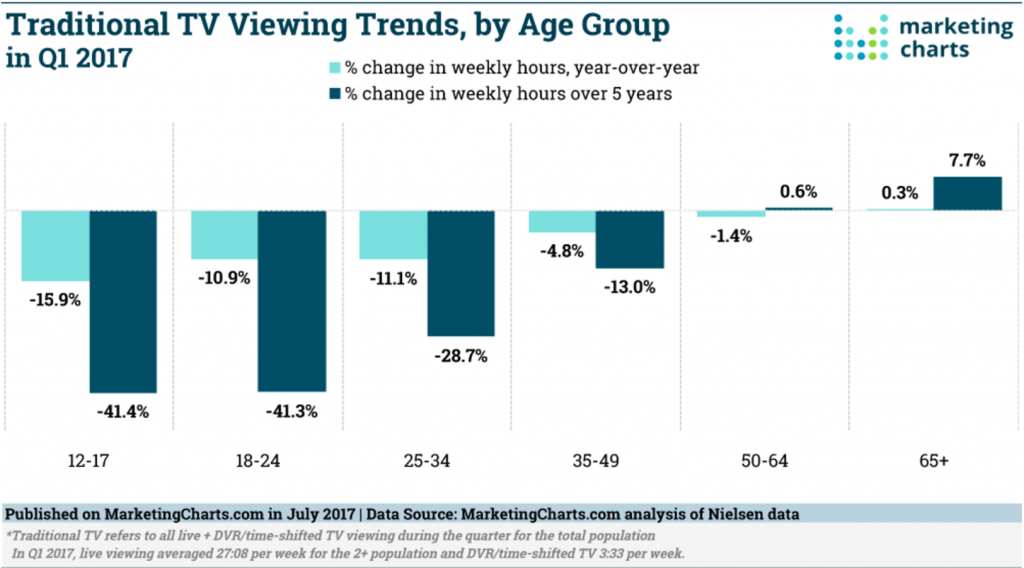

- Both teens and young Millennials have seen their traditional TV viewing evaporate by more than 40% over the past 5 years, and Teens’ traditional TV viewing fell by almost one-sixth in a single year; but at the other end of the scale the 50+ age group are pretty stable

And the good old anchor tenant of Sport (Rugby) might not be the golden goose anymore if international trends play out in NZ

- NFL Nielsen ratings were down 8 percent for the 2016 season and

- Those pesky millennials that aren’t watching TV aren’t as interested in live sport either.

These are all relative slow bleeds for Sky and revolutions often take a hell of a lot of time but they are coming.

Issue 2) But why do new customers always seem to get a better deal than existing customers.

It comes down to economics. The business case for acquisition is usually more compelling than a retention business case. Let me explain.

Acquisition Business Case:

An acquisition business case generally looks at the incremental customers you will acquire if putting an offer in market i.e. 6 months free sport. I worked up an example to show you how it works:.

- Your existing run rate of customer acquisition (100 customers)

- The cost of the offer (this could be lost revenue in the sport offer) (30 per month = $180)

- The expected run rate of customer acquisition as a result of the offer (300 customers)

- Increased cost of advertising ($100 per customer = 30,000)

- Your lifetime value of the customer ($140 x 12 x 4 years = $6,720)

- The return on the campaign = the net increase in customer acquisition x lifetime value of the customer less, cost of the offer, cost of advertising. (300-200) x $6,720 – (300 x $180) – (300 x 100) = $1,260,000 incremental revenue over four years

Whereas a customer lifecycle or churn reduction business case is a little bit more complex.

- The number of customers that you think you are going to churn (20%)

- The cost of the offer ($180)

- The reduction in the churn you will get from the offer (0.1%)

- And % of customer uptake of the offer (5%)

- The return on the campaign = the net saving in customers churned x customer value less cost of the offer. (800 x 6,720) – (800,000 x 5% x $180) = -$1,824,000

- Another way of looking at it, you need to save 1,071 customers to break even at a low 5% update of the offer. If the uptake increases then so do your costs.

The reason the acquisition business case is more profitable is a new customer is an incremental customer and only that customer gets the offer, whereas the churn offer is open to all customers and your uptake can significantly increase costs. That is why a lot of existing customer offers have an opt in mechanism, it is purely to ensure only the customers that want and value the offer receive it (limiting cost while being generous to all).

Oh, and one last thing, this has now got very public so you know any offer you give Zane with be spread all over the web and other customers will want it to, so you are a bit snooked no matter if you answer, give him an offer or remain silent…

So what would you do?

And good luck with the new job.

KS

PS: the players in the image above have terrible body positions – what’s going on?.