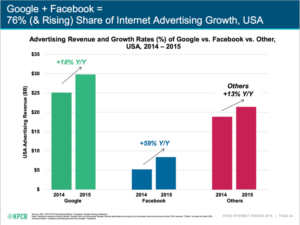

Last week we tapped a couple of highlights from the 213 page Mary Meeker 2016 Internet Trends report, zeroing in on the pain still to come for TV and print media. If traditional media is up against it, there’s a temptation to assume things will be commensurately rosy for the digital guys… however I’m not completely sold.

Digital is narrowing to a two horse race between Google and Facebook. Google is still some way ahead, and if their growth of 18% for 2014-2015 seems modest compared to Facebook’s 59%, we need to keep in mind the significant base Google works from. Given this 18% looks pretty damn impressive.

For both advertiser and audience it’s vitally important the “weaker” can find ways to compete. To do this other digital platforms need to refine business and commercial models, trying to find ways to reinvent themselves as commercially viable options.

And that’s why I think NZME and Fairfax should be allowed to merge.

Even as the biggest news sites in NZ, NZ Herald and Stuff only represent 11% of digital revenue. By contrast, Google and Facebook claim 53%. A mega-merger in NZ’s media sector still represents a small part of the overall market, especially given these two compete with global platforms and their accompanying global scale. Significantly though, NZME and Fairfax have proven they can work together – the KPEX JV has gained some traction and the partnership has delivered upside.

So where else could NZME and Fairfax create new commercial models and revenue streams? I think there are three main areas:

- Sell their audience (otherwise known as advertising)

- Sell a subscription (paywall, or a premium content model)

- Sell to the audience (or B2C ecommerce)

But… whisper it quietly, the headwinds against digital may be building. Nielsen’s data indicates that while 63% of the audience “trust” advertising on TV (with 60% still trusting print ad formats) only 46% trust ads served up on social networks. And the wonderfully outspoken Professor Ritson suggests goes even further, reckoning Twitter, Facebook and Instagram are massively over-rated by marketers, who reject traditional media at their peril.

And worse still for digital, the seeming holy grail of online video may actually be utterly ineffective. Stats suggest up to 81% of people mute these ads, while 62% are annoyed or put off. And adblocking? Well, when confronted by a video ad, up to 92% actively consider downloading blocking software.

Which brings us nicely to digital’s most existential threat. With use rising by 41% last year, adblocking software is becoming the real threat to the global social giants. That equals a loss of $US21.8 billion (or 14% of global on-line ad spend). This is expected to rise to $US41.4 billion in the current year. It won’t take long for this to create real impact with advertisers.

All of which likely leaves you completely confused. If last week I told you TV and print were knackered, and this week I’m saying digital is growing but with significant caveats – where does that leave you as a business? Just what are you supposed to take from all this?

The advice is surprisingly similar to last week. In fact it is EXACTLY the same. The more things change…

- You need to be where your customers are, engaging on their platforms of choice. Ignoring this is as dangerous of the sample of one… if you are aiming to catch me, don’t waste your dollars on print or TV.

- Understand your customer’s world view, and help solve a problem they have. Then tell authentic, engaging and emotional stories to them.

- Demand ROI measures from your media

- And if you are part of the media – you need to be better at telling your story and reinforcing how you reach and connect with an advertiser’s audience.

Finally, an interesting side note. I learnt this week that TV has a lower CPM (cost to reach 1,000 customers) than digital video. And when compared to long form video the cost could be as much as 6X lower. The challenge for TV? They have not sold this story to market in a compelling way, stuck selling spots vs an audience. How quickly could they convert advertisers if they could move from a 30 second spot in the 6.30 News costing X, to the equivalent of a CPM for reaching 18-39 year old males…???

KS